‘Subscribers Were Overwhelmed’: How Disney Made Streaming Profitable

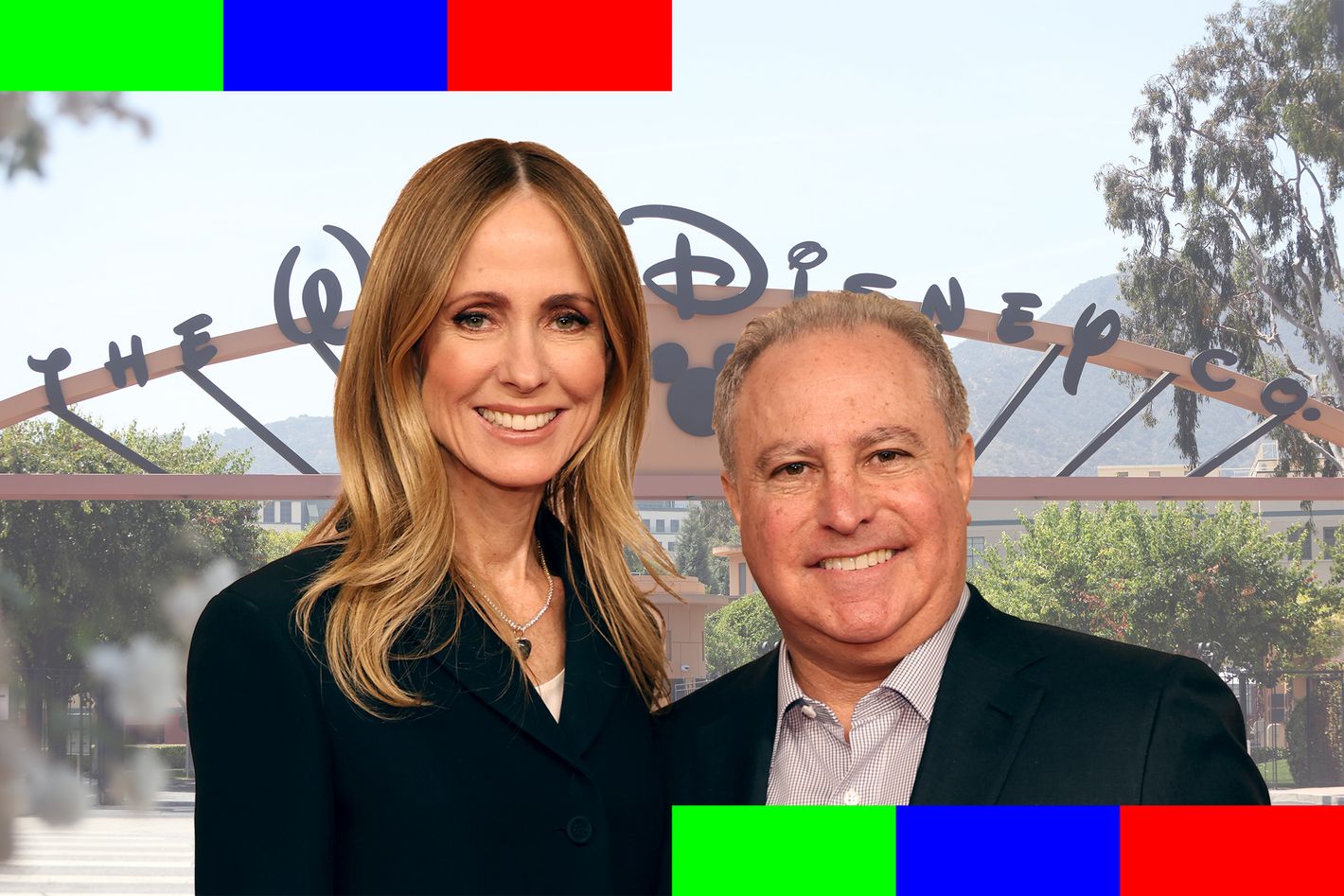

Dana Walden and Alan Bergman on the past, present, and future of Disney+.

For an entertainment conglomerate the size of The Walt Disney Co. — current market capitalization: just over $200 billion — $47 million usually doesn’t matter all that much to the bottom line. But in August, that exact figure took on outsize importance for the company because of what it represented: The first-ever quarterly profit by Disney’s streaming business. After racking up more than $10 billion of losses over the last half-decade, 2024 was the year Disney finally started making money from its digital platforms, turning the corner in what’s been an exceedingly difficult effort to reinvent itself for the Netflix era.

Obviously, painful cost-cutting and staff reductions, along with multiple increases in subscription prices, played a big role in reversing the sea of red ink at Disney streaming. And while August’s $47 million profit was followed in November by an even more impressive quarterly gain of $321 million, the company still has a ways to go to make up for all the debt it took on launching Disney+.

But even though there’s still plenty of room for improvement on the financial picture, more broadly speaking, Disney’s streaming business racked up notable victories on multiple fronts in 2024:

➽ On the programming side, multiple Disney TV brands had banner years, starting first and foremost with FX. Under John Landgraf, the network-turned-streaming-brand turned nearly universal critical praise for its big-budget Shogun into ratings success, while FX’s The Bear remained a pop culture phenom and Nielsen winner in season three. The two shows each set records for Emmy wins, and combined helped boost FX to dominate bigger rivals HBO and Netflix in the overall Emmy tally.

Meanwhile, Hulu scored hits in unexpected places (reality smash The Secret Lives of Mormon Wives) even as shows such as Futurama and Only Murders in the Building continued to be quiet streaming hits. Even ABC had notable triumphs in 2024: Fall drama High Potential was an immediate hit and is now broadcast TV’s No. 1 show in the key adults under 50 demo, while the network scored a major coup by stealing away rights to the Grammy Awards from longtime home CBS.

➽ Disney’s film unit bounced back from a couple of lackluster years with a trio of theatrical triumphs in 2024: Inside Out 2, Deadpool & Wolverine, and Moana 2. All of this is vitally important to Disney’s streaming business, since these box office blockbusters go on to become streaming staples. Inside Out 2, for example, gave Disney+ its most-watched movie in three years, while viewing of the original surged in the lead-up to premiere of the new films.

➽ On the tech side, the integration of Hulu into Disney+ was pulled off with minimal controversy — not at all a given considering the introduction of adult-themed content on a Disney-branded platform could have gone wrong. The move has resulted in more usage of Disney+ and viewership of Hulu programming, while also giving Disney the chance to move more customers into its Disney Bundle. Ditto this month’s introduction of ESPN+ on Hulu, as well as a move to give non-bundle users the chance to sample a significant number of Hulu and ESPN programs.

➽ Finally, Disney survived a nearly two-week carriage battle with DirectTV this fall, in the process securing more potential subscribers for all of the Mouse’s streaming platforms. As with 2023’s deal with Charter, DirecTV will now be able to bundle Disney streaming services with its linear channel offering. That in theory could help slow down cord-cutting while also driving viewership of Disney’s streaming platforms.

Yet the best metric to judge its success in 2024 — arguably even more important than its first quarterly profits — was how the company did in the battle for audience attention.

Much has been written about YouTube’s dominance of Americans’ digital screen time, but if you combine streaming with broadcast and cable viewership on TV sets, Nielsen says Disney has snagged a bigger share of viewing than any other conglomerate, including YouTube, every month since September. And in November alone, Disney properties accounted for 11.1% of all TV viewing in the U.S. as measured by Nielsen, beating not only YouTube (10.8%) and significantly in front of Netflix (7.7%). Huge audiences for sports programming on linear networks ESPN and ABC, as well as news coverage from ABC, help put Disney ahead of its rivals. But 43 percent of Disney’s viewership came from streaming, Nielsen says, and that number will continue to increase.

In a research report released last week, Wall Street analyst Robert Fishman of MoffettNathanson wrote that after several turbulent years marked by “management changes, proxy fights [and] euphoria- turned-skepticism” over streaming, Disney’s plan to remake itself as a streaming power “is finally moving from the realm of fantasy to tangible.” More importantly, “We believe Disney is on the road towards meaningful [streaming] profitability,” Fishman added. “It has taken years to build this business, and it will take yet another few years before returns become anything more meaningful, but the promised land is finally in sight.”

I think the original content strategy during the beginning of the streaming wars was not effective. Subscribers were overwhelmed.

- Dana Walden

Helping guide Disney toward that streaming promised land are two of Iger’s top lieutenants: Dana Walden and Alan Bergman, who as co-chairs of Disney Entertainment oversee all of the company’s content creation and platforms, including — especially — streaming. The duo were elevated to their current roles a little less than two years ago, in February 2023, not long after Iger returned to Disney and began the process of dismantling the Byzantine operational structure put in place by Iger’s successor/predecessor Bob Chapek. With Walden and Bergman in charge, the same Disney execs responsible for the production of Disney’s movies and TV shows also regained control of how their projects were distributed and marketed, both in the U.S. and around the world. More importantly, with the years of intramural corporate drama that marked the Chapek era behind them, Walden and Bergman, along with their direct reports—and ESPN chairman Jimmy Pitaro, who runs ESPN+— were able to focus on something much more important: Turning Disney into a successful streaming company.

That mission is far from accomplished, of course. Netflix made just over $2 billion in profit during its most recent quarter, roughly seven times what Disney pulled in. And in the competition for everything from top Hollywood talent to sports rights, Disney also has to worry about tech giants Amazon and Apple. The challenges ahead are real, but if the Mouse House is able to successfully navigate them, 2024 will likely be remembered as the year the Disney streaming turnaround began. To get some insight into how the company was able to reverse its streaming fortunes and win the year, I spoke with Bergman and Walden last Friday — a rare joint interview of the two executives. During a roughly 40-minute phone conversation (and one brief follow-up email exchange), the duo discussed everything from the current state of Marvel and Star Wars (including why The Acolyte was cancelled) to whether FX will continue to take risky bets like Shōgun in an era of cost-cutting. They also weighed in on perhaps the most urgent question of the hour for any parent with young kids: Will there be new full-length episodes of Bluey?

(This interview was conducted prior to a couple of Disney-related news developments, including ABC’s decision to settle pending litigation with president-elect Donald Trump and the revelation that a trans-related storyline has been removed from an upcoming Disney+ kids’ series.)

So thinking back on everything that happened with Disney streaming in 2024, one of the most important things was that the division finally turned a profit after years of losing money. Cutting costs was obviously a big factor, but can you explain what other moves you made to reverse the trend and put streaming on a path to profitability? And what are you doing now to ensure it becomes a sustainable business model for Disney?

Dana Walden: It has been the coming together of the creative teams across the company, and of creative executives being given authority over decisions that are made throughout our streaming business so there’s accountability. But it has to start with the very best stories. Across the board, whether you’re looking at the popularity of the shows, the awards, the critical acclaim, we start from a place of, “Are we delivering the very best stories to our subscribers?” And I think the answer is “yes.”

Then we’ve been steadily advancing our platforms. We hired a new head of technology, Adam Smith, from YouTube. He started three months ago and it’s been a bit of a game changer. You can see it in the number of tests that we have going on around the world that are enhancing the experience on our platforms. I think we have the best advertising team in the business led by Rita Ferro. In the fourth quarter, our global [streaming] ad revenue was a billion dollars, up 16% year-over-year. And we successfully executed Hulu on Disney+, Star and ESPN on Disney+ and Latin America, and ABC News Live on Disney+. We have a strategy, and the results are profitability early and tremendous growth potential.

Alan Bergman: We were actually losing, as you well know, several billion dollars. And in a couple of years’ time, we’ve turned it around. In addition to the initiatives that Dana has outlined, we’ve increased our price. Our price was very low when we rolled out the service. We’ve also grown subscribers substantially as well, and we have higher engagement and reduced churn. So we’ve sort of turned the corner on profitability. We’ve actually got there one quarter earlier than was anticipated. And when we look at the content that we have and timproved personalization, we are aiming towards our target of double-digit growth, double-digit margins by ‘26.

There was a period of time where we were making more movies directly for the service. But what we have learned is that our big theatrical movies perform incredibly well on the service

- Alan Bergman

The big fear among many people in the entertainment industry, not to mention consumers, is that getting toward those double-digit margins will mean a lot fewer shows and much higher subscription costs. Can you tell me how much you’ve had to reduce the number of shows and movies and other programming you make in order to get to a profit? Is it substantially less? And what about going forward?

Walden: Joe, you and I have had this conversation for a long time. We’ve never been the place that’s interested in making the most content; we want to make the best content. And we feel, ultimately, it’s about the right programming mix and not about volume. We also have programming coming from a number of different sources. We’re talking originals that are made specifically for our streaming platforms; we have films that are coming from Alan’s slate; and we have linear-first programs, which, when they hit Hulu, perform like originals.

And so I really don’t see the cutting back in programming, to be honest with you. I think the original content strategy during the beginning of the streaming wars was not effective. Subscribers were overwhelmed. They really didn’t know how to discover the right content. And the way we are organized around brands I think has really helped our subscribers to find programming that they want that they might not have known about before.

Additionally, there’s so much value in our bundle. We’ve just launched a sampling of Hulu content to standalone Disney subscribers, and those subscribers are already engaging meaningfully with that content. So we’re going to have the benefit of two opportunities: upselling those subscribers into the bundle and delivering more value to our subscribers.

Bergman: I would just add that, as it relates to the branded content coming from our studios, there was a period of time where we were making more movies directly for the service. But what we have learned is that our big theatrical movies really perform incredibly well on the service, particularly the sequels and prequels. Once we started marketing Inside Out 2, the number of streams and hours watched for [the first] Inside Out just went through the roof. And it was the same thing with Aliens, it was the same thing with Apes, same thing with Moana. So the marketing power of our big theatrical movies, across the entire world, makes everybody want to go into the library, re-watch these titles, and lifts the entire system. So we found that to be effective. We’re not, at this point, reducing our costs at all.

But there has been an adjustment down in terms of content spending overall or the number of projects you make, right?

Bergman: Well, on the studio side, as I mentioned, we were making a number of films that were going directly to the platform. But we realized, as we looked at their performance, they just weren’t performing as we needed them to perform. And we found that the pay one window titles were performing very, very well. So we readjusted how we looked at that. There has been less spending on original movies [for Disney+] coming from our side of the house, but we’ve gotten past that now, and where we’re going to be as we look at the volume going forward.

What about programming for originals at Hulu, FX, ABC and whatever is left of cable production? So much of TV historically has been cyclical. Is it possible that we’ll see the spending there go up again?

Walden: Well, one of the benefits of Alan and I working so closely together now is that we are programming our platforms holistically. So as we look out throughout the year, we’re programming general entertainment series around our big branded films when they hit the platform, and branded series as they hit the platform. And previously, I don’t want to say “siloed” — but the old structure of our company didn’t give us the opportunity to coordinate as carefully and as closely.

It is fair that we have cut back on some of the volume. Some of it again was just getting into streaming and trying to understand the volume which is necessary to succeed and what is the right mix. And again, we’ve got programming which is coming from our linear channels, along with our originals, along with the local originals that are being produced by our international teams. So I would say across the platform, it does not feel like we have turned down the volume [of production]. We have shifted the mix.

So Moana 2 was going to be a series, but you obviously decided to turn that into a theatrical release. And instead of making the next season of The Mandalorian, you opted to to The Mandalorian & Grogu for theaters. Were either of these tough calls? And what does it say about how you’ve evolved your thinking on your big franchises and streaming originals tied to them?

In its old version — FX at Fox — the economics would never have worked.

- Dana Walden, on FX making Shōgun

Bergman: These are two particular situations. As we were looking at our Disney animation slate, I felt that Moana 2 would be better served as a movie. And with The Mandalorian, as we looked at our Star Wars slate, we made the same kind of consideration. So it’s really title by title. But for us, looking at our big franchises, there’s nothing like a theatrical release because of the marketing power you get across the world. And because we’re a global service, these titles play everywhere.

Let’s turn to FX. It could have very much gone the way of TNT or USA, and basically no longer existed as a brand for high-budget original programming. You didn’t do that. When Disney absorbed Fox and FX, what convinced you and Bob Iger that FX had a place in this new streaming kingdom that you were building? And more broadly, what do you make of the success John Landgraf has had at FX this year?

Walden: Well, I really have to credit Bob with the vision. John and I have worked together for the past almost 30 years, but it was really Bob who saw an opportunity to take this brand — I mean, for John and his team to have established FX as a brand that stands for really premium content on a basic cable tier was a pretty extraordinary accomplishment. And I think Bob was a fan, and he understood immediately what John could do if he had the resources. Remember, this was a pretty bleak time for basic cable. Subscribers had already been cutting the cord. Young viewers in particular were leaving the cable ecosystem, and that was making it harder and harder for John to manage a budget that enabled him to take those really big swings. So it was fortuitous that at that exact moment, Bob stepped in and said, “I have a vision for a streaming future, and there is a place for a premium general entertainment brand like FX.”

And as soon as we walked onto the Disney lot, you could feel a shift in the creative community in the way they regarded an opportunity to work with FX, and what shows should be pitched there. And FX immediately saw the opportunity to protect this brand and fortify it going into the future and take swings on shows like Shōgun that, frankly, in its old version — FX at Fox — the economics would never have worked. So it has all come together to have created a brand that I believe will stand the test of time. It stands for quality, it stands for a certain type of programming, and subscribers know it when they see it.

I don’t think we’re going to go beyond — at least I don’t have any plans to go beyond — the two a year at this point.

- Alan Bergman, on the number of new Marvel shows on Disney+

Does the success FX had with Shōgun, which cost more than anything else the network has ever done, make it easier to take chances with more big budget projects that are also riskier? Or is the plan to focus more on smaller bets with modest budgets but potentially big payoffs, like The Bear?

Walden: Well, as you know, Shōgun season two is coming, so it’s a portfolio of projects. And that’s always been the strategy. That’s certainly what we’re trying to achieve on the general entertainment side overall, which is, we are producing shows like Shōgun or Nine Perfect Strangers or where Handmaid’s Tale is right now. And we’re also doing The Secret Lives of Mormon Wives, and a series of highly successful documentary series. And that’s our job, which is to fill a steady pipeline of content at a variety of different price points.

Alien: Earth is a big shot for John, and I’ve actually seen the first three episodes. It’s excellent and it feels huge, and we’re grateful to Alan and his side for letting us engage with that IP. But if you are going to trust one person in one team with beloved IP, I would say John’s about as good a bet as any. So, we are going to continue taking shots at all levels.

Alan, managing Marvel is a big part of your job. I wrote recently about Agatha All Along, which cost, I think by your own admission, less than any other Marvel show before. Both you and Bob have talked about capping Marvel shows at two a year, but if budgets can be kept in check without impacting quality, might you be open to revisiting that limit?

Bergman: Well, Agatha was certainly a big win for us, and widened out the audience that watches the Marvel titles. The movies have primarily been more male than female, and Agatha gave us an opportunity to try to hit the female audience more as well. As it relates to the number of titles, I don’t think we’re going to go beyond — at least I don’t have any plans to go beyond — the two a year at this point. But, you know, you never know. It just depends on what creative comes up as we look at each of our development titles.

In terms of costs, we’ve been looking at our costs very hard trying to make these titles as economical as possible. And some of them will have less visual effects than others, which can have a substantial impact on the cost. So clearly those with big visual effects cost significantly more. We have certain titles we’re looking at now that we’re testing that will have less visual effects and they’re more moderately priced.

We’re very well aware of the fact that they’re also majorly on YouTube. So we have a YouTube strategy.

- Dana Walden, on how young people are consuming entertainment

But the whole goal, in whatever we do, is quality. It’s the most important thing, and we won’t do anything that we don’t think is quality. So I think what you’re going to see is a mix of those series that have more visual effects and will certainly be more expensive. And then you’re going to see some titles that are less expensive because they have less visual effects. But what they’ll both have are great stories.

Staying on the franchise front, let’s talk Star Wars. It feels like it’s had a bumpier road of late compared to Marvel. The Acolyte had many strong reviews and did well in the ratings its first week out, but you ultimately opted against a second season. Why didn’t you move forward? And can you offer any hint as to how Skeleton Crew is doing, or its future?

Bergman: So as it relates to Acolyte, we were happy with our performance, but it wasn’t where we needed it to be given the cross-structure of that title, quite frankly, to go and make a season two. So that’s the reason why we didn’t do that. Skeleton Crew is in process now, so we’ll see. We’ve seen some growth on that. We’ll see how that goes. As you said, the reviews have been excellent on Skeleton Crew, so we’ll have to see how that all plays out as it moves forward.

What about the broader franchise, both on streaming and in theatrical?

Bergman: In terms of what’s coming up, we have Andor season two, which we’re really excited about. It is excellent. I’ve watched all the episodes, and it is a fantastic season. And then we have Ahsoka season two, which Dave Filoni is leading. And then we’re looking at a number of additional series that are in development. We’ll see what we decide to do. As I said earlier, they have to be great, and when we’re in the position where we think we have what we want, we’re going to move forward. In terms of the films, at this point we have Mandalorian, which is coming out Memorial Day of ‘26, and we’ve got a number of films that we are developing. When we’re ready, we’ll be making announcements as to what those are.

Dana, kids programming is obviously in the Disney DNA, and when you launched Disney+, there was an expectation you’d do well – that the kids audience in streaming was yours to lose. You’ve definitely succeeded compared to some other platforms which launched around the same time as Disney+; Max has all but gotten out of the kids business. But YouTube remains a huge threat to your historic dominance. What’s your plan going forward?

Walden: Well, I think we have a multi-pronged strategy. I would just point to Bluey: 800 million hours streamed last year, and they’re eight-minute long episodes. And we’ve really evolved our strategy in terms of where to find those youngest possible fans, and how to engage with kids where they are. And where they are is on Disney+, but we’re very well aware of the fact that they’re also majorly on YouTube. So we have a YouTube strategy with channels for Disney Junior, Disney Channel, Descendants. It’s all part of an ecosystem that continues to grow very important IP like Spidey and his Amazing Friends. We also recently launched our Streams, which are programmed channels – and our Playtime channel took off like a rocket. It is a benefit to a parent to not have to keep selecting another show when one ends. It’s a trusted stream of Disney kids programming.

Subscribers who watch adult animation watch 10 more hours monthly and are less likely to churn.

- Dana Walden

Let’s talk about Bluey. Are there going to be more full-length episodes? Would you ever consider just buying the IP from BBC Studios?

Walden: Thanks, Joe. Could you put that strategy on paper and just send it over to me? [Laughs.]

Of course! No, but what’s going on with Bluey? Will there be more full-length episodes?

Walden: I’m not in a position at this exact moment to tell you specifically what’s going on. What I will tell you is that we have a great relationship with the BBC and Joe Brumm. We just released another tranche of the mini-sodes this week. I believe in the future of Bluey. Specifically when something new will be launched, I can’t tell you in this call. But I’m pretty bullish about it. [Ed. note: A few days after this interview, Disney and BBC Studios announced plans for a Bluey movie, and Brumm announced he was stepping away from writing new episodes of the show, but that this does not mean the end of the series.]

So in addition to your programming for kids, Disney has carved out a strong niche with adult animation since the Fox merger. In addition to The Simpsons and Family Guy, Hulu has originals such as Solar Opposites and the reboot of Futurama. Can you talk about building up that business at a company like Disney?

Walden: I’m glad you asked this question. Our adult animation series have created one of the most meaningful brands in entertainment, and they are exclusive in streaming to Disney+ and Hulu. We dominate in this unique form of storytelling. We’ve made almost 2,000 episodes of four series: The Simpsons, Family Guy, American Dad!, and Bob’s Burgers. They’ve earned over 150 Emmy nominations and 48 wins and are among the top 10 most-viewed titles on our streaming services, globally. And most importantly, subscribers who watch adult animation watch 10 more hours monthly and are less likely to churn. Last year, our adult animation drove 3.7 billion hours of engagement on our platforms.

I’m curious about how long you think Simpsons, Family Guy, and Bob’s Burgers will continue to be shared with Fox. At some point, would shifting the shows exclusively to ABC or one of the Disney streaming platforms not make more sense? Or do you think it’s likely you’ll renew the current deal when it expires next year?

Walden: So, just like all shows that air first on ABC go to Hulu hours later, we have a similar arrangement with Fox. And Fox is a great broadcast partner that uses programming like football to promote the shows’ second window on Hulu and Hulu on Disney+. While I can’t get into too much detail about our deals, I will say that this is a strategy that works very well for the both of us and we’re very happy to continue this relationship – it’s a win-win.

Alan, Disney is once again licensing some of its Fox and Fox Searchlight films to outside streamers after they’ve premiered on your platforms. But you’re not doing this with new titles from Marvel, Star Wars and Pixar. Is there any chance that you’ll evolve that strategy, and once again license tentpoles to other streamers? I saw that Warner Bros. has already sold Barbie to Netflix, and that came out last year.

Bergman: Well, when it comes to our big, important, branded films from Disney, Pixar, Marvel, and Lucasfilm, we think about it in a very strategic way. And we think it’s a competitive advantage that we offer these titles on Disney+, and that you have to come to our service [to watch them]. Some of our non-branded titles we have licensed, and we’ll continue to look at that as the business evolves.

So that’s a “no” on Disney’s branded films being licensed outside Disney+?

Bergman: Not at this time, no. I don’t think it makes sense.

Similarly, Disney under Bob Iger has for years been focused on making tentpole franchises, many of which gross more than a billion dollars at the box office. When Hulu and Disney+ came into the mix, there was a thought that maybe we’d see you shift gears, and make more of those smaller, Fox Searchlight-style movies or non-franchise Disney movies. There have been a few, but not a lot. Any chance that changes as the Disney+ and Hulu ecosystems become more mature and more widely distributed?

Bergman: We are focused on the tentpole movies. And that really is a strategy that we’ve had in place for a number of years, and it’s worked for us. Because those big theatrical movies, in addition to trying to get to a billion dollars [with] as many of them as we can, what they do, they work through the entire company. So a movie like Moana 2 will have a big theatrical release, and then people will say, “Let’s go watch Moana 1 again.” Then consumer products will sell a bunch of merchandise. Ultimately, we’re doing stuff in the theme parks. It will be on Disney+; it will be games. So it lifts the entire company, and I think that’s a more strategic way of spending our money. This is something that Bob and I have discussed for a number of years, and when you look at what it means to the company, it is critically important.

We do have some of those movies that are sort of the smaller size titles where either we’ll go theatrically, like Freakier Friday, or we did Hocus Pocus 2 for Disney+. And we do have other movies that we’re looking at that will go directly to [streaming]. But there’s not going to be that many of them. We’re more focused on theatrical. Because we believe that when it goes theatrical … there will be a lot more awareness, given our ability to market it across the entire world. And it’s going to hit the service anyway.

Let’s end this by looking ahead. What do you think 2025 will bring, both for the industry overall and for Disney streaming?

Bergman: So we are incredibly focused on what we are doing. We’re certainly aware of what others are doing, but we don’t want to be followers. You’ve seen what we’re starting to do with sports. I think as we look forward, sports will become a more important part of the service. And I’ll just kind of leave it at that without getting into detail.

Walden: It’s hard to let yourself be distracted by what’s going on in the industry without losing the focus on what your priorities are. But clearly it seems like a logical assumption that more consolidation is in [Hollywood’s] near future. We don’t think that’s going to impact us. We are already consolidated. We have 100 years of the Walt Disney Company, and almost 100 years of Fox. We took those steps already, and we’re sort of six years down the road from that. So we feel like we’ve got a head start on what’s happening in the industry right now.

Related